If you’re a parent, you’ve probably heard of the 529 College Savings Plan. It’s been a go-to for families wanting to save for college—and for good reason. But lately, more parents (especially Kingdom-minded, legacy-focused moms like you) are asking: Is this the only way to plan ahead? Let’s explore the comparison of IUL vs 529 plans.

Understanding the differences and advantages of IUL vs 529 plans can significantly impact your financial planning.

Table of Contents

Let’s talk about a powerful (and often overlooked) alternative: the Indexed Universal Life (IUL) insurance policy.

You might be thinking, Wait… life insurance? For kids? Stick with me—because when used strategically, an IUL can be an incredible wealth-building and flexibility-boosting tool for your child’s future.

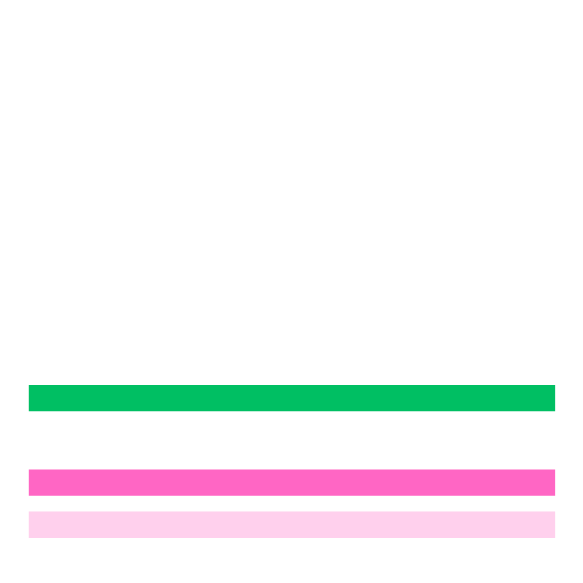

| Feature | 529 College Savings Plan | Indexed Universal Life (IUL) |

|---|---|---|

| Purpose | Primarily for education expenses | Long-term wealth building + protection |

| Tax Advantages | Tax-deferred growth; tax-free withdrawals for education | Tax-deferred growth; tax-free loans if structured properly |

| Usage Flexibility | Must be used for education to avoid penalties | Can be used for anything (college, home, business, etc.) |

| Investment Options | Limited to portfolios from the plan provider | Linked to stock market indexes (not directly invested) |

| Risk Level | Moderate risk; subject to market ups and downs | Lower risk; includes a 0% floor in most policies |

| Includes Life Insurance | ❌ No | ✅ Yes |

| Impact on Financial Aid | Considered a parental asset; affects FAFSA | Typically doesn’t affect FAFSA |

| Contribution Limits | Varies by state (often $300k+ lifetime) | No formal limit; higher amounts may trigger gift tax strategies |

| Withdrawals | Tax and penalty if not used for qualified education | Loans or withdrawals for any purpose, tax-free if structured correctly |

| Other Benefits | Some states offer tax deductions for contributions | Lifetime financial flexibility + protection + legacy-building |

So, Which One Should You Choose?

Understanding IUL vs 529 Plans: A Comprehensive Comparison

Honestly? It depends on your goals, values, and how flexible you want to be.

- Choose a 529 Plan if… you’re confident your child will pursue higher education and you want a dedicated, education-specific savings tool.

- Consider an IUL if… you want a flexible, tax-advantaged tool that can help fund any life milestone (college, home, business, etc.) while building long-term protection and generational wealth.

Real Talk: A True Story

I recently talked with a parent who felt confident in her 529 strategy. She’s planning for college, and that’s the goal. Beautiful!

But here’s the thing—what if your child doesn’t go that route? What if they want to launch a business, travel, or take a gap year? What if college isn’t the best fit for them, or you want to fund multiple milestones?

Another key difference? The IUL gives you, the parent, more long-term control. You’re not at the mercy of shifting college plans or restrictive rules. You can keep funding it, let it grow, and pivot when your child’s goals change—because let’s be honest, they probably will. This isn’t about predicting the future perfectly; it’s about preparing flexibly and wisely. That’s where an IUL shines. It doesn’t lock your money into one path. It grows with your child and gives you options—without penalties or strings attached.

Whether your child ends up in a college dorm or running their own business from a laptop in Costa Rica, the real win is knowing you gave them options. IULs are about building resilient wealth tools that don’t just prepare for one future—they support many. And in today’s world, that kind of flexibility is gold.

The Bottom Line: It’s Not Either/Or

This isn’t about one being “better” than the other—it’s about building a strategy that fits your family’s values and dreams. So, you should be one step closer to learning about IULs vs 529 plans. In fact, some parents choose to use both:

- A 529 Plan for immediate education expenses

- An IUL as a long-term financial foundation and backup plan

If you’re looking for a way to give your child freedom, protection, and options as they grow up—don’t sleep on the IUL.

Want to Learn More?

If you’re curious about how an IUL might fit into your family’s wealth strategy, let’s chat. I’d love to walk you through how it works and whether it’s the right fit for your goals. Book a CALL HERE.

Want to see how a 529 plan works in detail? The SEC has a helpful guide here.

Because building legacy doesn’t happen by accident. Let’s design it with intention.